FORS Fleet, Haulage & Goods In Transit Insurance

Exclusive Insurance Offering For FORS Operators

- Fleet Insurance – Cover all of your business vehicles under one policy.

- Haulage – Cover designed for large volumes of goods transported to a single destination.

- Goods In Transit – Protect your goods in transit from theft, loss or damage.

As a FORS operator you deserve to be recognised for your commitment and dedication to best practice in road safety, therefore we’ve arranged an exclusive insurance product offering for FORS operators that is tailored to meet the unique requirements of your fleet and haulage business.

Bespoke Tailored Coverage

- We Work With Industry Leading Markets To Get You the Best Rate

- Lloyds of London Commercial Broker

- Independent Broker Since 2001

The Fleet Covers We Offer

Professional Indemnity: Professional Indemnity Insurance refers to protection against incorrect or inadequate advice and services that you give. Unfortunately, any business can produce work resulting in both financial and reputational loss for their client and this is sometimes only uncovered long after the contract is completed. In this instance, your company can be held responsible which is when Professional Indemnity Insurance supports your business. At SJL Insurance Services, we provide insurance that can cover expenses, legal fees and pay outs incurred should an allegation be made against you by a client for providing an inadequate service.

Read more about Professional Indemnity Insurance

Fully comprehensive

Third Party, Fire & Theft

Third Party Only

Legal Protection

Motor Breakdown

Discover What We Have To Offer

This is the most advanced cover available and protects yourself against theft, fire, and third party as well as damage to your own vehicles and drivers

This offers more than just cover for your legal requirements, and means you are covered if vehicles in your fleet are stolen or damaged by fire, as well as covering you for injury or damage caused to third parties.

This is the lowest level of cover available under a fleet insurance policy, protecting you against injury or damage caused to third parties. You won’t be covered for any losses to your vehicles however.

This covers you for legal expenses following a claim, providing cover in the event the accident isn’t your fault and you need to take the other driver to court, or to protect in the even a third party takes legal action against you.

Motor Fleet insurance can cover damage to your vehicle, however does not protect against mechanical breakdown. This is where breakdown cover steps in to get you to where you are going, or a garage to get you fixed up.

We can insure any type of business, and our expertise ranges from property and commercial risks, to kidnap and ransom. Literally any type of business, in any sector, anywhere in the world.

Our expert brokers have access to a huge array of insurance products ensuring they can find the best insurance policy for you. They get to know your individual needs and provide the best possible insurance solution for you. You will be provided with an allocated account and claims manager, meaning there is a person who knows your business and policies in detail.

Our full list of Policys can be found below. Find My Cover

FLEET INSURANCE

By law, every road going vehicle must be insured to cover your liability to other people and their property. Many businesses own multiple vehicles, making insuring these individually on an annual basis a logistical and financial problem. However, SJL Insurance Services offer Fleet Insurance which covers all of your business vehicles under one policy, meaning one renewal date. As a FORS recognised insurance broker, you can rely on us to insure your fleet with a customer policy so you only pay for the cover you need.

DO I NEED FLEET INSURANCE?

Fleet Insurance benefits any business with more than one vehicle. Save time, money and effort by utilising a more manageable insurance type. This is the ideal solution for business owners who don’t want the hassle of insuring each of their company vehicles individually.

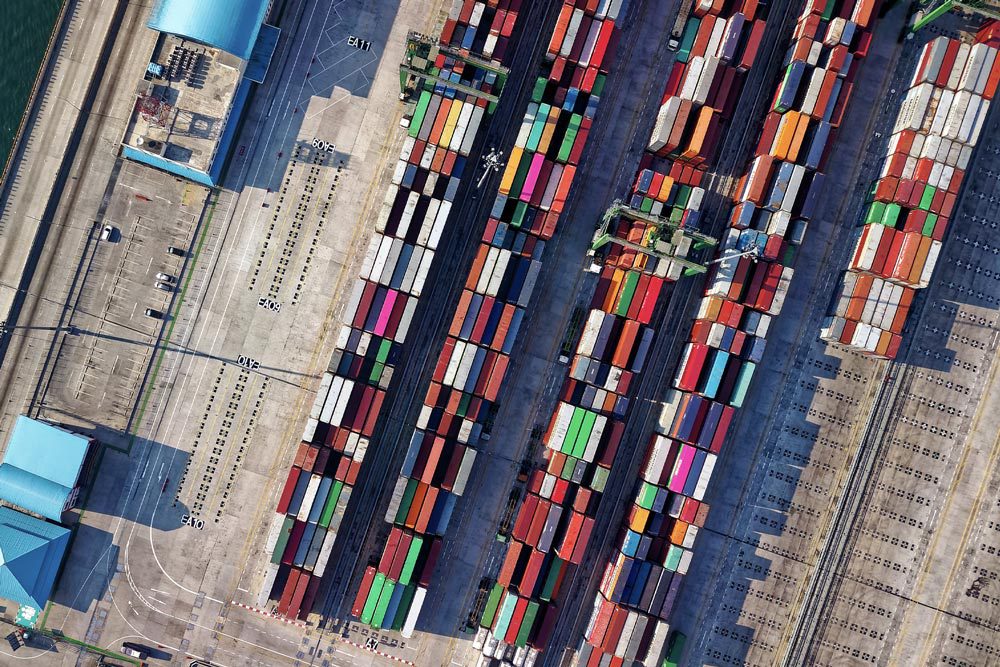

HAULAGE INSURANCE

Haulage Insurance is insurance cover designed for businesses and operators who transport large volumes of goods to a single destination. This is often as part of a contract, whereby goods are shipped, often over large distances, to a fixed location.

Due to the nature of haulage services and the significant amount of goods they transport (in excess of 3.5 tonnes), vehicles such as HGVs are often operators’ biggest investment.

Haulage Insurance therefore protects businesses and operators of haulage vehicles against risks associated with transported goods over vast distances such as theft, accident and damage.

DO I NEED HAULAGE INSURANCE?

If you transport goods over large distances in vast loads and have expensive vehicles to do so, having Haulage Insurance could make all the difference to the longevity of your business should anything happen in transit. Despite the size of your company, the correct cover is imperative for ensuring your HGVs are protected.

If you are also contracted to arrange the storage of third-party goods, then it is essential that you are correctly covered, should any loss or damage occur. Your customer’s requirements may vary and so restrictions and limitations within your policy should be considered in detail to ensure the insurance covers any losses. At SJL Insurance Services, we can design a policy around both your needs and your customer’s needs.

However safely your drivers operate your haulage vehicles, there will always be the risk of property damage, injury to an employee or to a member of public. For that reason, it is important that you have Hauliers liability insurance.

GOODS IN TRANSIT INSURANCE?

Goods in Transit Insurance, also know as GIT Insurance, or Marine Cargo Insurance, protects your goods in transit from theft, loss or damage and provides confidence in your delivery services. Cover items that your business moves from one location to another, knowing that you have support should your cargo come to any harm.

A policy can be taken out by either the owner of the goods or by a haulage business carrying the goods.

DO I NEED GOODS IN TRANSIT INSURANCE?

Designed to protect the contents of your vehicles and your goods whilst being transported by others; this insurance is important for any companies that transport items or have items transported on their behalf. Most goods become the responsibility of the buyer when they leave the supplier so choosing the right haulier and having the right insurance is of high importance. Couriers and those in the delivery service have an added need to have the right insurance to protect their customers and themselves.

WHY SHOULD I CHOOSE SJL INSURANCE SERVICES FOR MY FLEET, HAULAGE AND GOODS IN TRANSIT INSURANCE?

SJL Insurance understand the commitment you put in as a FORS operator, with your dedication to road safety and to road safety and adhering to the FORS Standard it’s only fair you are rewarded. With SJL Insurance Services, you can insure all of your company vehicles under one insurance policy. Our easy to manage insurance packages allow your drivers to be fully insured on each of your vehicles; without the hassle of updating driver details. SJL Insurance Services provide quality insurance to haulage companies and fleets within businesses of all trades, including couriers and highly mobile businesses.

SJL Insurance Services can also provide you with a number of different covers, ranging from Third Party insurance cover only, to Fully Comprehensive insurance cover.

- Over 22+ years of experience in the fleet market

- Lloyds of London Insurance Broker (so have access to the whole market)

- Meets requirement V3 ‘Insurance’ of the FORS Standard

- Able to cover all vehicles and types

- One policy for all vehicles

- Insurance cover from just two vehicles

- Dedicated account manager

- FORS operators recognised by insurers to help with endorsements

- Reassurance that you’ve got the best cover at the right cost

- No obligation insurance consultation

Get a FORS Fleet, Haulage & Goods In Transit Insurance quote for the cover you need,

and have peace of mind knowing that you're protected.

Related News/Posts

Winter driving tips and checklist for fleet operators

@sjl.insurance12 Tips For Fleet Operators During Winter Driving ♬ Poppiholla – Chicane Managing a fleet during winter can be challenging due to rapidly changing weather

Road Safety Week

@sjl.insuranceIt’s road safety week! Organised by Brake, the road safety charity. We all drive too fast sometimes… “I didn’t notice I was going so fast!”

SJL Announces Exclusive Insurance Partnership with FORS

SJL Insurance Services (SJL) Announces Exclusive Partnership with FORS to Provide Specialised Fleet and Haulage Insurance Insurance brokers, SJL are thrilled to announce an exciting

Things to look out for on your fleet this summer

Protect your fleet over they summer and beyond As we continue through the Summer, the change in temperature and rainfall can affect our vehicles. If

Insuring a growing business

Scaling up a business often involves taking on additional risks and exposures, which can be mitigated through the purchase of business insurance. Scale-up business insurance

Fleet Insurance – Managing Your Risk

Account Manager Tobie Vermeire provides some insight, Fleet management and insurance advice in partnership with Fleetmaxx Solutions.