Haulage Insurance

FORS exclusive insurance partner- Cover designed for large volumes of goods transported to a single destination.

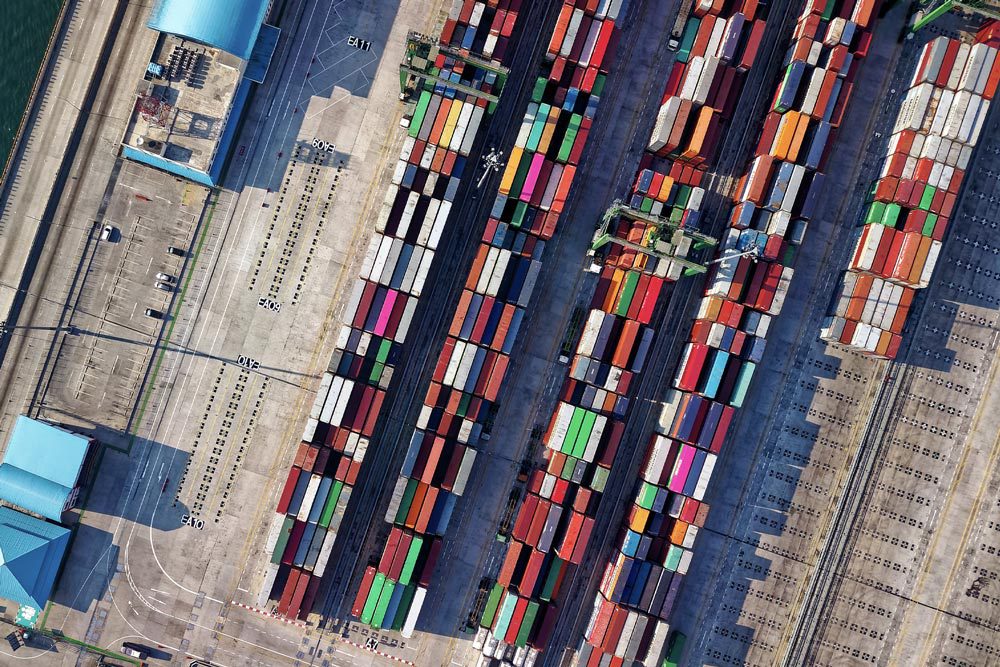

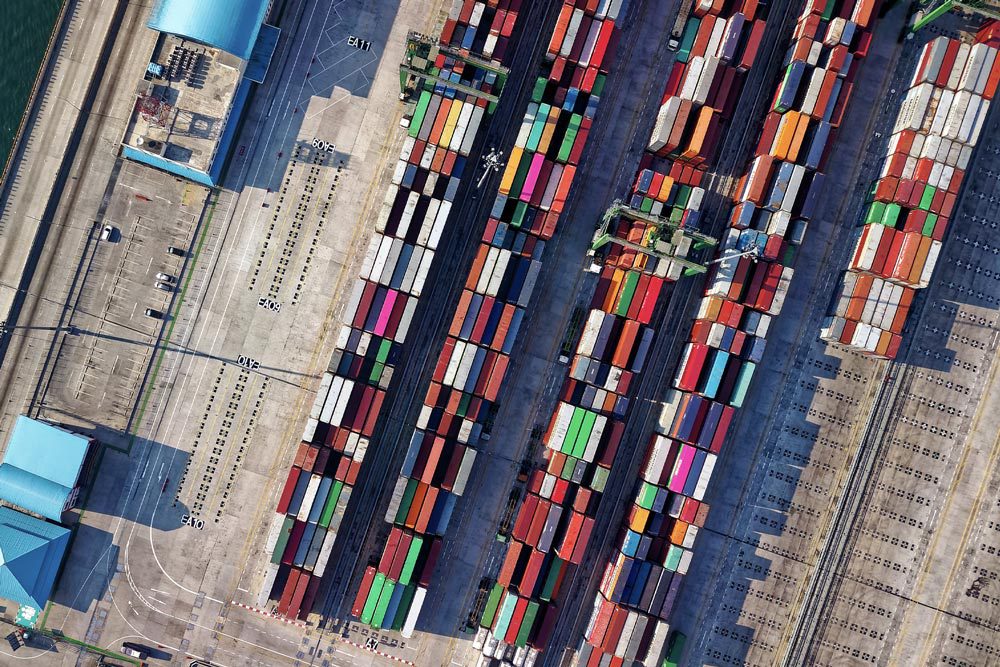

Haulage Insurance is insurance cover designed for businesses and operators who transport large volumes of goods to a single destination. This is often as part of a contract, whereby goods are shipped, often over large distances, to a fixed location.

Due to the nature of haulage services and the significant amount of goods they transport (in excess of 3.5 tonnes), vehicles such as HGVs are often operators’ biggest investment. Haulage Insurance therefore protects businesses and operators of haulage vehicles against risks associated with transported goods over vast distances such as theft, accident and damage.

- Award Winning In-House Claims Team

- Lloyds of London Commercial Broker

- Independent Broker Since 2001

Professional Indemnity: Professional Indemnity Insurance refers to protection against incorrect or inadequate advice and services that you give. Unfortunately, any business can produce work resulting in both financial and reputational loss for their client and this is sometimes only uncovered long after the contract is completed. In this instance, your company can be held responsible which is when Professional Indemnity Insurance supports your business. At SJL Insurance Services, we provide insurance that can cover expenses, legal fees and pay outs incurred should an allegation be made against you by a client for providing an inadequate service.

Read more about Professional Indemnity Insurance

WHAT IS THE DIFFERENCE BETWEEN HAULAGE INSURANCE AND COURIER INSURANCE?

Haulage Insurance tends to cover those who deliver large loads to one fixed destination. It is usually as part of a contract, with operators working on behalf of third parties, using their vehicle to deliver goods on behalf of another business.

Courier Insurance is designed for those who deliver items to multiple locations as part of a courier service. This is often over a shorter distance and can differ on a day-to-day basis with a large variety of different goods and products. Courier services are often considered more high-risk that haulage because of this and requires a policy that can cover a number of risks.

If you would are looking to ensure the goods that are transported by your business and don’t require Haulage or Courier Insurance, visit our Goods in Transit Insurance page.

WHAT IS THE DIFFERENCE BETWEEN HAULAGE INSURANCE AND GOODS IN TRANSIT INSURANCE?

Goods in Transit Insurance is cover for the items that you carry when in transit. This helps protect your business should anything happen to goods whilst being transported. It can be taken out by those who transport goods on behalf of a client, or by those who transport their own goods and want cover against damage, theft or loss of items.

For more information, visit our Goods in Transit Insurance page.

Haulage Insurance (and Courier Insurance) primarily cover the vehicle/s that is transporting goods, whereas Goods in Transit is cover specifically for the items that are being transported.

If you want to cover both, then you just need to ensure that you have Goods in Transit cover included in your Haulage Insurance policy. Contact our team if you’d like to discuss your insurance options.

DO I NEED HAULAGE INSURANCE?

If you transport goods over large distances in vast loads and have expensive vehicles to do so, having Haulage Insurance could make all the difference to the longevity of your business should anything happen in transit. Despite the size of your company, the correct cover is imperative for ensuring your HGVs, tucks and lorrys are protected through road haulage.

If you are also contracted to arrange the storage of third-party goods, then it is essential that you are correctly covered, should any loss or damage occur. Your customer’s requirements may vary and so restrictions and limitations within your policy should be considered in detail to ensure the insurance covers any losses. At SJL Insurance Services, we can design a policy around both your needs and your customer’s needs.

However safely your drivers operate your haulage vehicles, there will always be the risk of property damage, injury to an employee or to a member of public. For that reason, it is important that you have Hauliers liability insurance.

We can find you the right policy at a competitive premium, so please contact us if you would like to discuss your options.

WHAT IS COVERED IN HAULAGE INSURANCE?

Haulage Insurance is specifically for the protection of haulage vehicles such as HGVs. For businesses who transport very large amounts of goods across large distances, it is important that you are covered against the risks that you are exposed to when you carry goods.

SJL Insurance Services have access to specialist schemes at Lloyd’s of London and in the composite market, specifically designed for Haulage Contractors. Our team of specialists can access and build the perfect policy for your business needs, meaning your Haulage Insurance can cover whatever it is you require.

Depending on how your business works and the level of cover you require, Haulage Insurance policies can cover:

- Theft of vehicle

- Damage to vehicle

- Accident caused by a third party

- Injury to employees

- Injury to members of the public

- Fire

If you would like to discuss options with one of our expert team members and find out what would work best for you, please contact our team today.

HOW MUCH DOES HAULAGE INSURANCE COST?

As an insurance brokers, SJL Insurance Services has access to a huge array of insurance services and options. Our team build bespoke cover for your individual business needs, to ensure that you are covered effectively but are only paying for what you need.

If you would like a cost for insuring your Haulage company, please complete our form and request a free, no obligations quote now.

and have peace of mind knowing that you're protected.

Related News/Posts

Winter driving tips and checklist for fleet operators

@sjl.insurance12 Tips For Fleet Operators During Winter Driving ♬ Poppiholla – Chicane Managing a fleet during winter can be challenging due to rapidly changing weather

Road Safety Week

@sjl.insuranceIt’s road safety week! Organised by Brake, the road safety charity. We all drive too fast sometimes… “I didn’t notice I was going so fast!”

SJL Announces Exclusive Insurance Partnership with FORS

SJL Insurance Services (SJL) Announces Exclusive Partnership with FORS to Provide Specialised Fleet and Haulage Insurance Insurance brokers, SJL are thrilled to announce an exciting

Things to look out for on your fleet this summer

Protect your fleet over they summer and beyond As we continue through the Summer, the change in temperature and rainfall can affect our vehicles. If

Insuring a growing business

Scaling up a business often involves taking on additional risks and exposures, which can be mitigated through the purchase of business insurance. Scale-up business insurance

Fleet Insurance – Managing Your Risk

Account Manager Tobie Vermeire provides some insight, Fleet management and insurance advice in partnership with Fleetmaxx Solutions.